3 Easy Facts About International Debt Collection Explained

Wiki Article

Debt Collection Agency Things To Know Before You Buy

Table of ContentsThe 8-Minute Rule for Personal Debt CollectionThe Facts About International Debt Collection UncoveredAbout Personal Debt CollectionDebt Collection Agency Can Be Fun For Anyone

The debt purchaser gets only an electronic documents of details, commonly without sustaining evidence of the financial debt. The debt is also generally really old financial obligation, in some cases referred to as "zombie debt" due to the fact that the financial debt customer attempts to revive a debt that was past the statute of constraints for collections. Financial obligation collection agencies might call you either in creating or by phone.

Not speaking to them will not make the financial debt go away, and they may just try different methods to contact you, consisting of suing you. When a debt collection agency calls you, it's vital to obtain some first details from them, such as: The debt collection agency's name, address, as well as telephone number. The total amount of the financial debt they declare you owe, consisting of any kind of charges and rate of interest costs that might have built up.

Not known Factual Statements About Dental Debt Collection

The letter has to specify that it's from a financial obligation collector. They must additionally inform you of your civil liberties in the debt collection procedure, and also exactly how you can challenge the debt.If you do dispute the financial obligation within thirty days, they must stop collection initiatives until they give you with evidence that the financial debt is your own. They need to offer you with the name and also address of the original creditor if you ask for that information within thirty days. The debt recognition notice must consist of a form that can be made use of to call them if you wish to dispute the financial obligation.

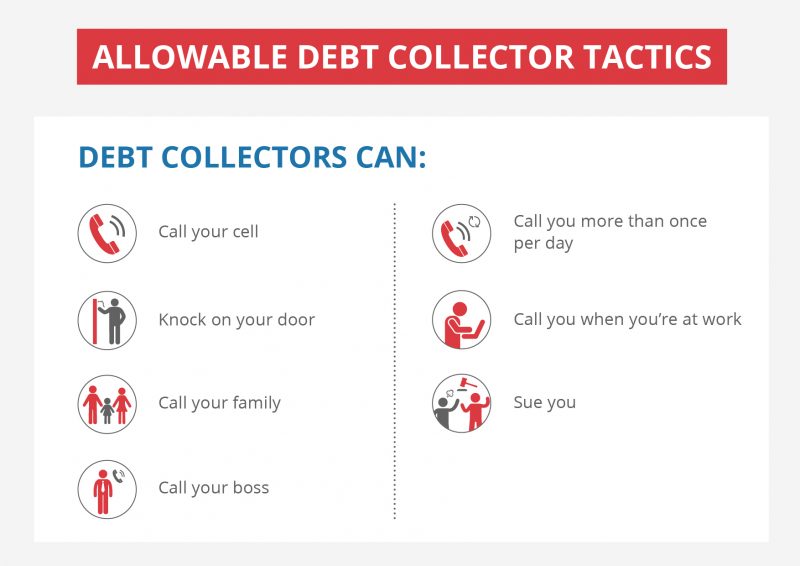

Some points financial obligation collectors can refrain are: Make repeated calls to a debtor, intending to irritate the debtor. Endanger physical violence. Usage profanity. Lie concerning just how much you owe or make believe to call from a main federal government office. Normally, debt is reported to the debt bureaus when it's 1 month past due.

If your financial debt is transferred to a financial obligation enthusiast or marketed to a financial obligation buyer, click here for more an entry will be made on your credit score record. Each time your financial obligation is marketed, if it continues to go unpaid, another entry will certainly be included in your credit rating report. Each negative entrance on your credit rating report can remain there for up to seven years, even after the debt has actually been paid.

All About Business Debt Collection

But what should you anticipate from a debt collector and just how does the process job? Keep reading to discover. Once you have actually made the decision to employ a debt collection agency, make certain you select the appropriate one. If you follow the guidance listed below, you can be confident that you've worked with a trustworthy company that will handle your account with treatment.Some are much better at obtaining outcomes from bigger services, while others are experienced at collecting from home-based services. See to it you're dealing with a business that websites will in fact offer your requirements. This might appear noticeable, but before you employ a debt collector, you require to guarantee that they are certified as well as certified to work as financial debt collectors.

Prior to you begin your search, understand the licensing requirements for debt collector in your state. In this way, when you are interviewing agencies, you can talk intelligently regarding your state's demands. Talk to the agencies you speak with to ensure they satisfy the licensing demands for your state, especially if they are located elsewhere.

You ought to likewise get in touch with your Better Company Bureau and the Commercial Collection Company Association for the names of trusted and also extremely concerned financial debt collectors. this contact form While you might be passing along these financial obligations to a collection agency, they are still representing your company. You need to recognize exactly how they will certainly represent you, exactly how they will certainly deal with you, as well as what appropriate experience they have.

What Does Personal Debt Collection Do?

Even if a strategy is lawful does not mean that it's something you want your firm name connected with. A trustworthy debt collection agency will certainly work with you to set out a strategy you can cope with, one that treats your previous customers the method you would certainly intend to be dealt with and also still does the job.If that happens, one tactic many agencies utilize is avoid mapping. That indicates they have accessibility to specific data sources to aid situate a borrower that has left no forwarding address. This can be an excellent tactic to ask about particularly. You must likewise dig into the enthusiast's experience. Have they collaborated with business in your market before? Is your situation outside of their experience, or is it something they recognize with? Pertinent experience boosts the possibility that their collection initiatives will be successful.

You should have a point of contact that you can interact with and also obtain updates from. Business Debt Collection. They need to have the ability to plainly express what will be gotten out of you at the same time, what information you'll require to supply, as well as what the tempo and also causes for interaction will be. Your chosen company needs to have the ability to accommodate your chosen interaction needs, not compel you to accept theirs

Ask for evidence of insurance from any kind of collection agency to secure on your own. Financial debt collection is a service, and also it's not an inexpensive one.

Report this wiki page